There's a constant flood of FUD in the mainstream media, for reasons which become obvious when connecting the outlet owners with their respective state money printers. Fortunately, there's an ambudance of freedom loving independent journalists and educators creating incredible content. Here you will find links to quality resources to help seperate the signal from the noise.

Podcasts

citadeldispatch.com

John Vallis - Bitcoin Rapid-Fire

Video’s delen met vrienden, familie en de rest van de wereld

Anita Posch - Bitcoin educator, author and founder of Bitcoin for Fairness

Learn Bitcoin with author and educator Anita Posch. Thoughts on societal and economical impacts of Bitcoin for humanity and financial freedom.

Books

The Bitcoin Standard

Bitcoin: Everything divided by 21 million | Konsensus Network Store

Satoshi stumbled upon a discovery of a new, weightless, absolutely scarce element. The showstopper for each and every time thief. Element zero. Bitcoin.…

Andy Edstrom, CFA, CFP – Author of Why Buy Bitcoin

Articles

Bitcoin’s Meme Wars — Citadel21

Bitcoin.

Parker Lewis, Author at Unchained Capital

Bitcoin-native financial services

Tomer Strolight – Medium

Read writing from Tomer Strolight on Medium. Destroying the lies that imprison people. Every day, Tomer Strolight and thousands of other voices read, write, and share important stories on Medium.

Breaking News

No Bullshit Bitcoin

No Bullshit Bitcoin Is a Bitcoin News Desk Without Ads, Paywalls, or Clickbait.

No Bullshit Bitcoin

RHR

Rabbit Hole Recap

stacker news

It’s like Hacker News but we pay you Bitcoin.

Stacker News

Short Films

Films

Talks

Interviews

Keynotes

Art

cryptograffiti

#bitcoin activist artist

Bitko Yinowsky – The Official Bitko Yinowsky Store

Rebel Money

Music

Check out Wavelake and LN Jukebox for a taste of how bitcoin over lightning (aka Zaps) is revolutionising the music industry.

The Orange Pill Jam Project

Bitcoin Music 4 Hyperbitcoinization The Orange Pill Jam Project, is a copyleft, open source, Bitcoin only music collective. Contributing to Bitcoin adoption and education, with high quality PoW Sound and low time preference lyrics. Mixing traditional types of music with modern beats and effects that make you move, groove and dance.

We want to create music that embodies Bitcoin values, such as a healthy mind and body, sustainability, no borders and freedom. Dive into a fresh and tropical Gypsy-DUB, Afro-Latin, Hip-Hop Fusion, have fun and Bitcoin. • If you wish to contribute, let the SATs flow on our Geyser Crowdfunding campaign (link ↓) • Or do it directly over Lightning: orangepilljam@getalby.com No amount is too small. Don’t forget to follow us on socials and other platforms (links ↓) Enjoy, stay up to date, engage, network, or maybe even join us!

Learn Bitcoin - Structured Learning

Plan B Network

Saylor Academy | Saylor Academy

Build new skills or work towards a degree at your own pace with free Saylor Academy college courses.

Node Academy

Node Academy is an initiative of Vancouver Bitcoiners to help enthusiasts getting started with their own Bitcoin Lightning Network node. It is part of the Pacific Nodewest noderunners community and open to everyone.

Learn Bitcoin - Guides

Bitcoin Guides And Tutorial Videos | Keep It Simple Bitcoin

Learn how to interact with Bitcoin through video guides and tutorials. These Bitcoin guides introduce you to software and hardware made for Bitcoin.

Bitcoiner.Guide

A collection of Bitcoin resources by BitcoinQnA

werunbtc

Circular Economies

BTC Map - Countries Leaderboard

Easily find places to spend sats anywhere on the planet.

Media Organisations

TFTC – Truth for the Commoner

Curated content that surfaces truth and provides actionable advice in a world filled with gaslighting and complaining.

BitcoinTV.com

A repository of educational video content for the Bitcoin community, without distractions like advertising, altcoins, or third-party trackers.

Magazines

Citadel21

Citadel21 is a cultural zine about Bitcoin. Made by Bitcoiners.

Manifestos

A Cypherpunk's Manifesto by Eric Hughes published on 9 March 1993

Newsletters

Newsletters

Helping Bitcoin-based businesses integrate scaling technology.

Marty’s Bent

A daily newsletter highlighting signal in Bitcoin.

Stack Sats Newsletter

A weekly newsletter highlightning Lightning Network metrics, news, and resources for anyone to start stacking sats.

Lifestyle

Ungovernable Misfits - The Uncensored Movement

The uncensored movement fuelled with a thought-provoking Podcast, Captivating Art and Streetwear— all focused on Bitcoin, self-sovereignty, and a society that embraces true freedom

Online stores that accept bitcoin

Spend Satas is a regularly updated database of online businesses accepting bitcoin . Discover ways to spend or utilize bitccoins you hold

Dashboards & Explorers

Dashboard

The entire Bitcoin economy at a glance

The Mempool Open Source Project™

Explore the full Bitcoin ecosystem with mempool.space™

Bitbo | Bitcoin Price Ticker Live Dashboard (Real-Time)

View live price action, monitor on-chain data, and track key economic indicators - all for free.

Hardware

SeedSigner: Air-gapped DIY Bitcoin Signing Device

BUILD YOUR OWN BITCOIN SIGNING DEVICE using a raspberry pi zero (VERSION 1.3) You can build an offline, air-gapped Bitcoin transaction signing device from off-the-shelf components for less than $50! Quick Installation The fastest and easiest way to run the latest version of SeedSigner is to download…

Blockstream Jade: The first purpose built hardware wallet for Liquid. And everything else.

Traders. Hodlrs. Investors. Your Hardware wallet is here. Jade is the most advanced hardware wallet yet.

Trezor Hardware Wallet (Official) | Bitcoin & Crypto Security

The safest cold storage wallets for crypto security and financial independence. Easily use, store, and protect Bitcoins.

BTClock – A block with multiple eInk displays

Mobile Wallets

Blockstream Green: Simple and secure Bitcoin wallet

Blockstream Green makes it easy to get started sending and receiving Bitcoin and Liquid-based assets such as L-BTC and Tether’s USDt.

Breez | The Interface of the Lightning Economy

Breez is realizing the future of bitcoin by opening the world of peer-to-peer payments to people and apps

Conferences

Bitcoin Conferences Worldwide | bconf.org

Find all Bitcoin conferences happening around the globe in one place.

BTC Prague - The biggest bitcoin event in Europe

The biggest, most influential bitcoin event in Europe ever, again!

Bitcoin 2025 - Las Vegas

The Bitcoin Conference is the world’s largest gathering of bitcoiners. From breaking announcements and international media coverage to countless meaningful talks by thought-leaders and industry innovators, we are excited to continue our drive for global hyperbitcoinization. From May 27th - 29th, 2025, The Bitcoin Conference will be coming to Las Vegas, Nevada

.jpg)

Entertainment

Bitcoin Whitepaper for Gen Z

Bitcoin: A Homie-to-Homie Digital Cash Vibe

The Bitcoin Bugle

News so fake you will think it’s real!

Bitcoin Obituaries - “Bitcoin is Dead” Declared 400+ Times

Until today “Bitcoin is dead” was declared more than 400 times. This is the official source for all Bitcoin obituaries since 2010.

Getting Involved

Modify Open-Source Projects

Beginner friendly guide to Open Source projects

Games

Bitcoin Games - THNDR Games

Play to earn bitcoin games! Simple, fun and free! Download one of our mobile bitcoin games today! Available on the App Store or Google Play! Play now!

Gamertron - Sats-Man

Play Sats-Man | Sats-Man Scoreboard

ZEBEDEE – Play. Earn. Shop

Step into a universe of games and apps that reward you with real Bitcoin!

Maps

BTC Map

Easily find places to spend sats anywhere on the planet.

Tools

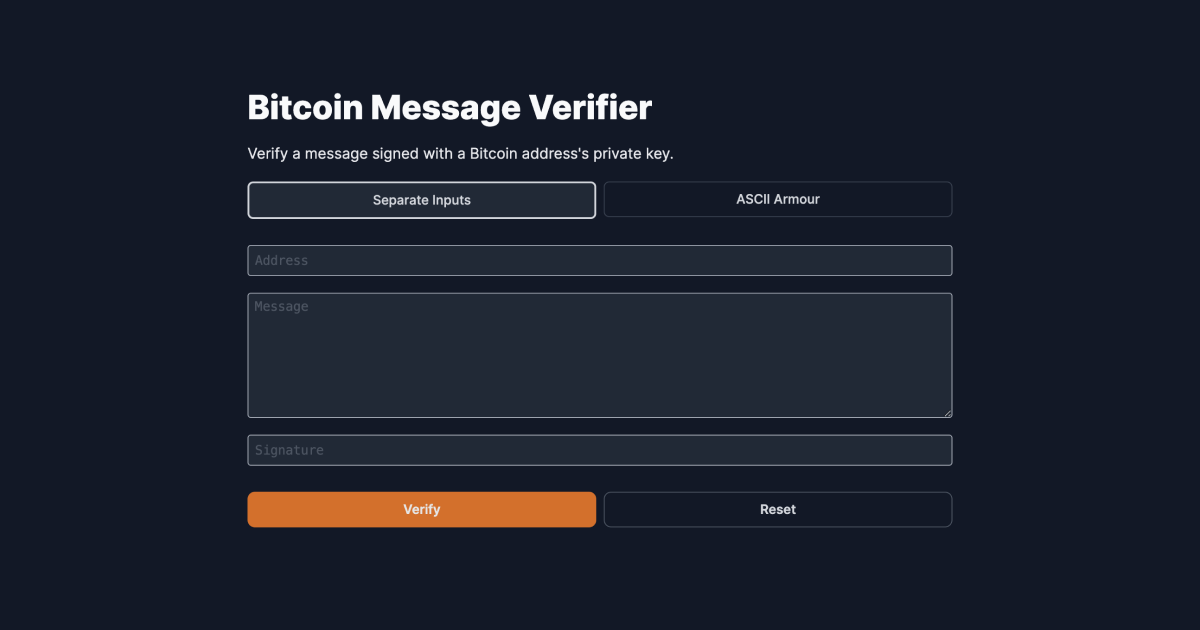

Bitcoin Message Verifier

Verify a message signed with a Bitcoin address’s private key.

How to write a message on the Blockchain - Eternity Wall Blog

Eternity Wall, messages lasting forever. Posts a little less…

Wallets Recovery [Beta]

Information about wallet defaults for external recovery

Exchanges

Learn RoboSats

A simple and private way to exchange bitcoin for national currencies. Use RoboSats with Tor Browser GitHub Project Page

Boltz

Boltz is a Privacy First, Non-Custodial Bitcoin Exchange and Lightning Service Provider

Bitfinex | Cryptocurrency Exchange | Bitcoin Trading | Futures Trading | Margin Trading

Bitfinex | Cryptocurrency Exchange | Bitcoin Trading | Futures Trading | Margin Trading

Please do not leave funds on exchanges. Not your Keys, Not your Coins!

Mining

Bitcoin Mining Industry Introduction \ stacker news ~bitcoin_beginners

Thanks @clarksoucy for the presentation, waiting for you to join SN and send you some sats. This was part of the last meetup held at BoBspace in BKK last Wed. Are you in Bangkok? Join us next Wed! 01.png 2013: 1st Gen Mining Machines Arrive Mining was done on home computers until 2013. The first mining machines were designed and shipped by Zhang Nangeng (Canaan) and Zhan Ketuan & Wu Jihan (Bitmain) in Beijing in 2013. The total network computing power (Hashrate) is measured in Exahash or quintillions of hashes per second. Bitcoin price and Hashrate have generally increased in tandem as a higher price incentivizes miners do deploy more mining machines. 02.png Major Players Emerge Bitcoin mining computers (application specific integrated circuits - ASICs) is the sole segment of the global semiconductor industry that is dominated by Chinese companies. These companies design chips along the latest nodes and then outsource production to Samsung & TSMC. Bitdeer, led by a cofounder of Bitmain, Wu Jihan, is the newest entrant to the market. Intel already scrapped nascent ASIC business. Joules Per Terahash* (J/TH) as a measure of machine efficiency (lower is better) Leading machines from Bitmain/MicroBT are ~16-18. Canaan is 21.5 Bitdeer recently announced 18, will ship in August 2024. 2017-2018: Rapid Growth in ASIC Sales Bitmain and Canaan both applied around the same time to go public on the Hong Kong Stock Exchange in 2018. Zhan & Wu court institutional investors (Sequoia and others) and grow much faster than Canaan. First 6 Months 2018 Financials: Bitmain Revenue: $2.8B USD (10X yoy) Bitmain Net Profit: $742M USD Canaan Revenue: ~$292M USD Canaan Net Profit: ~$30M USD Canaan’s total revenue in 2022 was $651M USD, so Bitmain’s scale today is probably larger than in 2018. ASIC Sales Business Model • ASIC manufacturers prepay for wafers 5-6 months in advance, so they must estimate future demand. • ASIC demand is not entirely correlated with the Bitcoin price; it is also influenced by inventory levels of new and used machines, mining farm availability, and miner cash balances. • ASIC sales are highly profitable during bull markets, but some ASIC manufacturers (Canaan) sold below cost during the last bear market. • Mining is a highly capital intensive business and miners normally replace their machines every 2-3 years, depending on their power costs and profitability. 03.png Where is Bitcoin Mined? Mining used to be very concentrated in China due to low power costs. Neither mining nor machine sales are banned in China, instead mining was described as an undesirable industry that shouldn’t be expanded by government circulars in 2021. After China’s circulars, mining migrated worldwide, but the USA has probably become number one by deployed machines and has the most publicly listed miners. Other major markets for major private miners now include Central Asia, Southeast Asia, The Middle East, and South America. Precise location data is not possible to ascertain. Most major miners are looking for $0.05 cent per kilowatt hour or cheaper power. Some miners are using artificially cheap power. There Are Multiple Mining Business Models Besides mining for themselves, some miners host others’ machines for a fee in their data centers to diversify revenue. Leveraging cloud mining, where machines are leased at a fixed price for a set term to a customer who directly receives the Bitcoin produced by said machines, BitFuFu was one of the only miners to have positive net income during the 2023 bear market. Most miners hold most of the Bitcoin they mine, but some like Bitdeer and Iris Energy liquidate all or most of it immediately. Impact of change in FASB rules on net income of miners due to fair value accounting may be problem for miners as gains in the value of the Bitcoin they hold will be added to net income. Bitcoin Mining Stocks & Public Capital Markets Investors choose Bitcoin mining stocks because they have operational leverage on the Bitcoin price due to relatively fixed costs for power. As the Bitcoin price increases, so do miner margins. 04.png Serious Dilution from ATMs and Convertibles Many public miners are currently using equity issuance to order new machines and pay expenses. In the past cycle some felt compelled to sell Bitcoin or raise financing at difficult times with onerous, expensive terms. 05.png Valuation Metrics - Market Capitalization 07.png Valuation Metrics - Rank Miners By Capacity Marathon, Bitdeer, Hut 8, and Core have the highest capacity, but with the exception of Marathon they have large hosting businesses and in Bitdeer’s case, cloud mining operations. Core recently emerged from bankruptcy. 08.png The Cost To Mine Integration with power grids lowers costs (Riot demand response arrangement with Texas grid operator). Vertical integration, whereby miners control their own mining data centers, versus paying others to host their machines, is a key strategic question due to the higher cost of relying on hosting. Marathon, long mostly reliant on hosting, has been investing in vertical integration to lessen reliance on hosting partners and reduce costs. 09.png Valuation Metrics - Revenue Multiples Low cost to mine, vertical integration, and cooperation with grid operators lead to higher valuations. Debt burdens at Core, Stronghold, Terawulf. Lack of large institutional shareholders across the sector absent sector ETFs. 10.png Valuation Metrics - The Hosting Discount Miners that engage in hosting and cloud mining have these operations valued lower by the markets. Pure play proprietary miners (Riot & Marathon, & Cleanspark) continue to enjoy valuation premiums. 11.png Valuation Metrics - Bitcoin Held The average miner is valued at 7.2X the value of it’s Bitcoin holdings, but there are serious divergences and the multiple will probably contract in the future. 12.png Valuation Metrics - Projected Mining Results Riot sold 57% of the Bitcoin it mined in the five fiscal years through 2023. Adding Bitcoin held to future mining projection is one possible valuation multiple for listed miners, after deducting Bitcoin sold to pay for costs 14.png Presume 25% transaction fee and 700 EH Total Network Hashrate After Halving and disclosed miner capacity expansion through 2025. Conclusion: Mining is Diverging Between Two Competing Strategic Models Industry leaders are choosing two distinct strategies: 1. Pure play proprietary mining (Marathon & Riot & Cleanspark) 2. Diversified mining operations that mix proprietary mining with cloud mining (BitFuFu), hosting (Hut8), and also ASIC sales and AI data centers (Bitdeer). Mining is a low barrier to entry arms race. The miners with the lowest cost of capital, electricity, and greatest capacity will pull ahead over the long term. But how to finance expansion? Sell Bitcoin or sell shares or take on debt? Or use hosting, cloud mining, and ASIC sales to cross subsidize operations? Expect continued emphasis on vertical integration and cooperation with power grids to lower mining cost. 13.png [2 comments]

.png)